when will capital gains tax increase uk

The allowance will not rise with inflation which means that gains on the sale of a second home or shares that are not in an ISA are more likely to face a tax charge in the future. A finance chief is warning that the threat of possible rises in Capital Gains Tax should be dismissed by the government to help the buy to let sector.

Uk Capital Gains Tax For British Expats And People Living In The Uk Experts For Expats

A property sell gives you an upside gain and when you sell it you are liable to pay 18 capital gains tax CGT in the standard category or 28 if you were in higher tax brackets.

. For those on basic rate income tax the rate will depend on the size of the gain taxable income. In the event of a property sale if the sale resulted in capital gains tax the profits will be taxed at 18 on the sale value or 28 on the income if the sale resulted in capital gains tax. When the Treasury introduced changes to the Entrepreneurs Relief now Business Asset Disposal Relief in the spring 2020 Budget the government outlined the proposed changes to the legislation some of which were effective from the Budget date 11 March 2020.

The changes will be effective from the new tax year starting 6 April 2021. Although it is now clear Capital Gains Tax CGT and Inheritance Tax IHT rates and allowances have avoided changes in 2021 they are still very possible for the budget in 2022 or in future years. Taxes on capital gains in 2021-22 and 2020-21 will be adjusted according to inflation.

Jonathan Samuels the chief executive of Octane Capital says. You know at the end of the day its a tax on profits they are actually realised profits. Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value.

Taxes on the gain from selling other assets rise to 10 for taxpayers with basic tax rates and to 20 for taxpayers with higher. For those who pay a higher rate of income tax or a trustee or business the rate is currently 28 per cent on gains from residential property and 20 per cent on gains from other chargeable assets. December 30 2021 by Brian A.

In the last tax year of 2019-2020 HM Revenue Customs collected record amounts of capital gains tax as experts predicted this figure would continue to rise. If capital gains tax rates were aligned with income tax rates the top rate of capital gains tax would increase to 45 percent in Britain. Another one from Alan.

Capital gains tax The capital gains tax allowance has also been frozen at its current amount 12300 a year for individuals until 2026. Tax rates on capital gains are set for 2021-22 and 2020-21. The uk government announced five key technical and administrative changes to capital gains tax cgt on 30 november also known as tax administration and maintenance day.

Because the combined amount of 20300 is less than 37500 the basic rate band for the 2020 to 2021 tax year you pay Capital Gains Tax at 10. HMRCs yield from Capital Gains Tax has risen significantly in recent years with the latest total almost double the 81bn collected five years ago and more than treble the. But you have a tax-free allowance of 12300 in the 202122 tax.

The biggest question asked of private client advisors over the past couple of years is when do we expect capital gains tax cgt to increase. One of the areas the government is looking to increase its tax collection from is capital gains. The government has tried its hardest to dampen investment into the private rental sector in recent years with a string of.

CGT is a tax on the profit when you sell an asset that has increased in value. Putting the S in OTS. Bidens Capital Gains Tax Increase Capital Gains Tax Rate 2022 It is commonly accepted that capital gains are gains realized through the sale of assets such as stock real estate stock or even a business and that these profits constitute taxable income.

These reports suggest amendments to the existing system. The Government may reveal its. Its the gain you make thats taxed not the.

Yes so I think capital gains tax potentially will increase. When it comes to determining the amount you have to pay to tax on these. UK Capital Gains Tax.

This article discusses the journey of capital gains tax CGT in the last. Taxes united-kingdom capital-gains-tax capital-gain. Have you heard of any potential CGT increases in the UK.

In the last six months the Office of Tax Simplification OTS has published two reports evaluating the effectiveness of the capital gains taxation system in the UK. Or could the tax rate be retroactively applied to the 202122 tax year. The increase would be substantially bigger from 20 to 45 therefore it would be good to know if this does take place should assets be sold off before the end of this tax year.

Capital Gains Tax 2022 Uk - Capital Gains Tax Rate 2022 - It is commonly accepted that capital gains are gains made through the sale assets such as stock real estate a property or a company and these earnings are taxable income. The maximum capital gains are taxed would also increase from 20 to 25. He told the Telegraph.

Theres talk of CGT capital gains tax increasing in the US if Biden gets in. If the tax rate is 10 investors will pay this fee while investors will pay 20. The UKs Capital Gains Tax bill has jumped 35 from 108bn to a record 146bn in the past year following a rise in tax on entrepreneurs selling businesses says Bowmore Financial Planning.

Capital gains tax only becomes an issue on shares held outside an Isa and a pension which also grows free of capital gains tax.

Get Ready For 178 Billion Of Selling Ahead Of The Capital Gains Tax Hike These Are The Stocks Most At Risk Marketwatch Capital Gains Tax Capital Gain Tax

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

Https You 38degrees Org Uk Petitions Increase Tax On Unearned Assets Like Shares And Second Homes Bucket Email Blas Budgeting Open Letter Business Investment

With The Run Up To The 31st January Filing Deadline Hmrc Has Issued A Reminder To Be Aware Of Self Assessment Scams Self Assessment Assessment Tax Return

Do I Have To Pay Capital Gains Tax When I Gift A Property The Telegraph In 2022 Capital Gains Tax Capital Gain Setting Up A Trust

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

The Capital Gains Tax And Inflation Econofact

The Age Of Big Data Talent Development Development Education And Training

Capital Gains Tax Reporting And Record Keeping Low Incomes Tax Reform Group

Uk Taxation On Shares Example Forex Trading Forex Trading Brokers Forex Trading Training

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

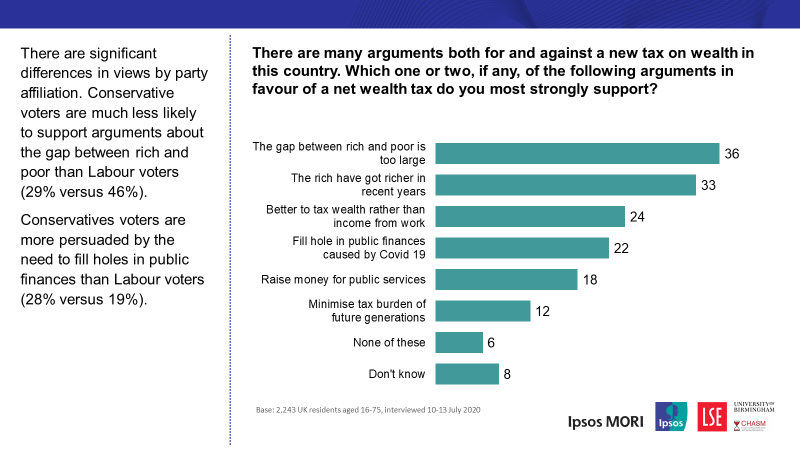

Britons Support Paying More Tax To Fund Public Services Most Popular Being A New Net Wealth Tax Ipsos

Introduction Of Pit Exemption Of Capital Gain Derived From Sale Of Asean Stock On Asean Linkage Property Valuation Capital Gains Tax Getting Into Real Estate

Simmons Simmons Hmrc Tax Rates And Allowances For 2021 22

U K Treasury Told To Avoid Tax Increases As Budget Deficit Growsby Alex Morales David Goodman And Andrew Atkinson2 Capital Gains Tax Budgeting The Borrowers

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

How To Reduce Your Capital Gains Tax Bill Vanguard Uk Investor